In February 2018, Jerome Powell was appointed as Chair of the Board of Governors of the Federal Reserve System. He became the 16th chair to take over the helm of the world’s most influential central bank.1 Among other duties, he and the Fed governors are tasked with adjusting short-term interest rates to help control inflation in an effort to promote overall economic growth.

In recent years, inflation has remained low, which has allowed the Fed to maintain low, short-term interest rates. But some are concerned that the Fed’s interest rate policy may accelerate inflation in the future, and they are looking for investment opportunities that have the potential to react to higher interest rates.

A Few Tips

Unlike conventional U.S. Treasury bonds, the principal amount of Treasury Inflation-Protected Securities, or “TIPS,” is adjusted when there are changes in the Consumer Price Index (CPI), which measures changes in inflation. When the CPI increases, a TIPS’s principal increases. If the CPI falls, the principal is reduced.

The relationship between TIPS and the CPI can affect the amount of interest you are paid every six months as well as the amount you are paid when your TIPS matures.2

Remember, TIPS pay a fixed rate of interest. Since the fixed rate is applied to the adjusted principal, interest payments can vary from one period to the next.

When TIPS mature, the bondholder will receive either the adjusted principal or the original principal, whichever is greater.2,3

If you are concerned about inflation – and expect short-term interest rates may increase – TIPS are an investment that may be worth considering. A close review of your overall strategy might also reveal other investment choices that may be appropriate in an environment of changing interest rates.

Inflation In Perspective

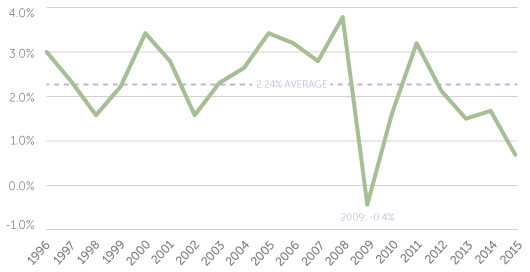

In recent years, the Consumer Price Index has bounced below 2.16%, its average rate for the past 20 years.

Source: USinflationcalculator.com, 2018

- Board of Governors of the Federal Reserve, 2018. For the 20-year period ended December 31, 2017

- The interest income from a Treasury Inflation-Protected Security (TIPS) is exempt from state and local taxes. However, according to current tax law, it is subjected to federal income tax. Adjustments in principal are taxed as interest in the year the adjustment occurs even though the principal adjustment is not received by the bondholder until maturity. Individuals should consider their ability to pay the current taxes before investing.

- TreasuryDirect.gov, 2018