At LifeBright, we’ve designed each portfolio with ease and efficiency in mind. We automatically re-balance all LifeBright accounts, regardless of size, without extra fee’s.

We automatically harvest gains/losses for tax efficiency. We have designed a portfolio to fit your risk/return profile—without sacrificing competitive performance. In addition, because we don’t use proprietary mutual funds or exchange traded funds (ETF’s), we’re free to select the investments we believe best support each investors focus.

LifeBright Exclusive Portfolios

Whether you need growth or income, or want to be conservative or aggressive we have a portfolio for you!

Still not convinced? Check out our 1 yr, 3yr, and 5yr performance vs. our national peers; Company (S), Company (B), Company (W)*

Focus: Low starting balance, low fund expenses, and no transaction fees

Balance: $2,500 minimum

Management Fee: 0.45% annual fee on balances of $5,000 or more.

Comprised of no transaction fee Exchange Traded Funds (ETFs), LifeBright offers a low-cost way to invest. Using a diversified mix of ETF’s, you get broad market exposure at an affordable price. Your recommended portfolio will be customized to the level of risk you feel comfortable taking. Your investment profile will automatically identify which allocation best fits your financial needs.

For investors that prefer more interest and dividend income, we’ve got you covered. Our short questionnaire will automatically guide you to the appropriate portfolio allocation that increases interest and dividend income.

Whether you’re looking for growth or income, your portfolio will be well diversified, risk/return appropriate, and easy to understand.

*Past performance does not guarantee future results.

Check out of our diversified portfolio allocations. Regardless of your tax-bracket or your need for growth or income,

we have a portfolio for you!

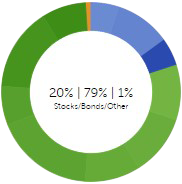

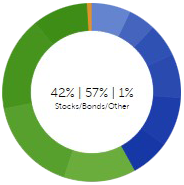

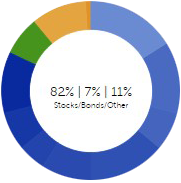

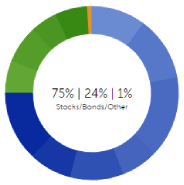

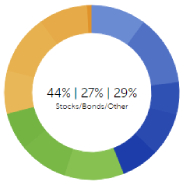

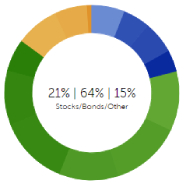

Index Advantage Portfolios

-

Conservative

Portfolio -

Moderately

Conservative Portfolio -

Moderate

Portfolio -

Moderately

Aggressive Portfolio -

Aggressive

Portfolio

- Diversified Bonds

- Diversified Stocks

- Other (May including preferred stocks, convertible bonds, real estate, and alternative investments)

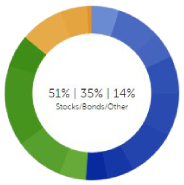

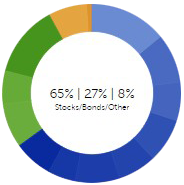

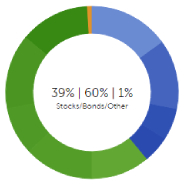

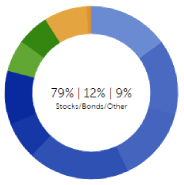

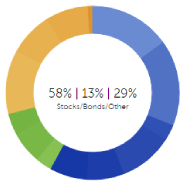

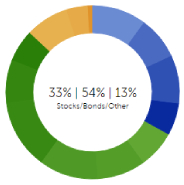

Index Advantage Tax-Aware Portfolios

-

Conservative

Portfolio -

Moderately

Conservative Portfolio -

Moderate

Portfolio -

Moderately

Aggressive Portfolio -

Aggressive

Portfolio

- Diversified Bonds

- Diversified Stocks

- Other (Including preferred stocks, convertible bonds, real estate, and alternative investments)

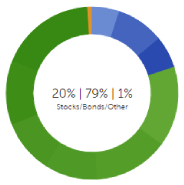

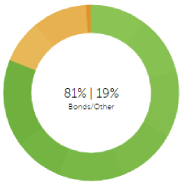

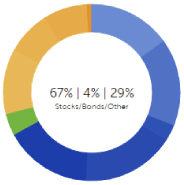

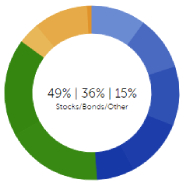

Income Advantage Portfolios

-

Conservative

Portfolio -

Moderately

Conservative Portfolio -

Moderate

Portfolio -

Moderately

Aggressive Portfolio -

Aggressive

Portfolio

- Diversified Bonds

- Diversified Stocks

- Other (Including preferred stocks, convertible bonds, real estate, and alternative investments)

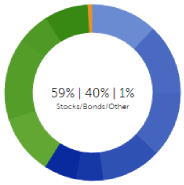

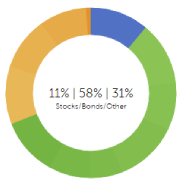

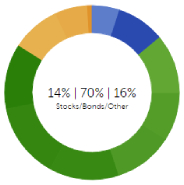

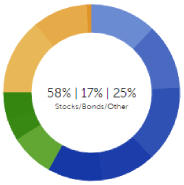

Income Advantage Tax-Aware Portfolios

-

Conservative

Portfolio -

Moderately

Conservative Portfolio -

Moderate

Portfolio -

Moderately

Aggressive Portfolio -

Aggressive

Portfolio

- Diversified Bonds

- Diversified Stocks

- Other (Including preferred stocks, convertible bonds real estate, and alternative investments)

Something For Everyone!

Something For Everyone!